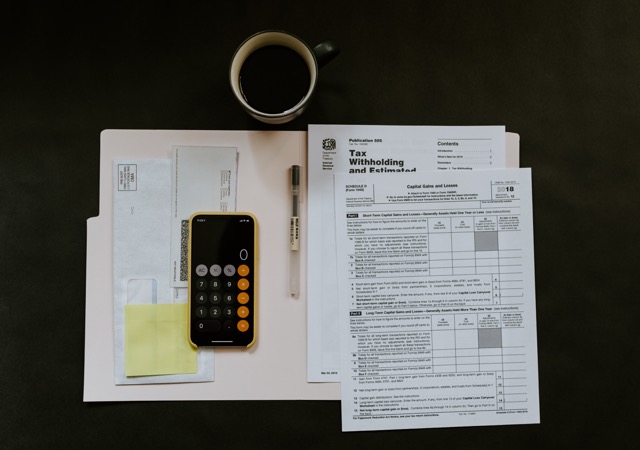

The 2019 tax rates and tax brackets for Canada can be found below. Use these to determine how much you may owe at tax time.

How do the tax brackets work in Canada?

The basic personal amount is the income level below which no taxes are levied. Even for those who earn less than the personal amount, filing a tax return is important. It can mean benefits such as the GST/HST credit.

What are the Canada tax brackets for 2019?

[table id=31 /]

What are the provincial/territorial tax rates?

Your province and territory will have its own tax rates.

The Newfoundland and Labrador tax rates for 2019

[table id=22 /]

What are the Prince Edward Island tax rates for 2019?

[table id=3 /]

The Nova Scotia tax rates for 2019

[table id=4 /]

What are the New Brunswick tax rates for 2019?

[table id=23 /]

The Ontario tax rates for 2019?

[table id=24 /]

What are the Manitoba tax rates for 2019?

[table id=25 /]

The Saskatchewan tax rates for 2019?

[table id=8 /]

What are the Alberta tax rates for 2019?

[table id=26 /]

The British Columbia tax rates for 2019?

[table id=27 /]

What are the Yukon tax rates for 2019?

[table id=28 /]

The Northwest Territories tax rates for 2019?

[table id=29 /]

What are the Nunavut tax rates for 2019?

[table id=30 /]

How deductions can lower your tax bill

Maximizing your deductions and tax credits can lead to a lower tax bill. The CRA outlines some of the most-used deductions and credits.

If you're self-employed, you can typically write off costs related to your business. This can include things like equipment. But, don't forget about the value of things like your business mileage.