As a business owner or self-employed individual, the mileage deduction remains one of the best ways to save on your tax bill. The more business miles you drive, the greater opportunity you have to claim those expenses on your annual tax return. Although HMRC permits mileage tracking for tax reimbursements, you do need sufficient proof to back your claims. A mileage log, otherwise known as a logbook, allows you to keep accurate records of business drives so your mileage can be properly reimbursed come tax season.

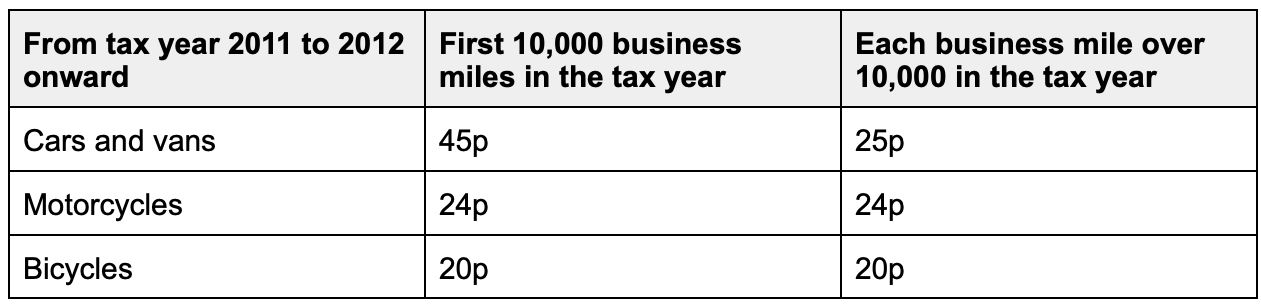

How do you calculate a mileage deduction? Fortunately, it’s easy to compute using the HMRC mileage allowance rates. Below we’ll detail the standard rates you can use to claim reimbursement for any business trips you take in 2023.

What is the HMRC mileage rate for 2023?

The HMRC mileage rates have remained unchanged since the 2011-2012 tax year. Here is a look at the current approved mileage rates for cars and vans, motorcycles, and bicycles in 2023:

Even though HMRC sets a standard rate each year, UK employers are allowed to set a different rate for reimbursement. In the circumstance that your employer pays at a lower rate, you may apply to HMRC for mileage allowance relief to cover the difference.

What does the 45p mileage allowance include?

The standard mileage rate of 45p is designed to cover all costs associated with the business use of your personal vehicle. These expenses include automotive insurance, road tax, depreciation, fuel costs, repairs and maintenance. Because the HMRC won’t allow you to estimate your mileage, it’s important to keep contemporaneous records of all business miles as well as receipts or invoices for vehicle expenses. You are not required to submit this documentation to the HMRC, however, you will need to hold on to any records for at least five years in the event of an audit.

What is the best method for tracking business mileage?

Since business owners and self-employed individuals have a lot of expenses to keep track of, it’s crucial to choose a method that fits well into your busy lifestyle. An automatic mileage tracking app is arguably the simplest way to turn your business trips into big savings at the end of the year. While you focus on your day to day tasks, the MileIQ app runs in the background of your smartphone device to accurately record your trips for a mileage reimbursement or deduction. If you choose not to use a mileage tracking app, there is always the paper and pen method. With that said, the latter option creates a higher chance of misplacing pertinent tax information or maintaining inconsistent records that are needed to support your mileage claims.

To learn more about the travel guidelines for using your personal vehicle for business use, visit GOV.UK for fuel rates, passenger payments, and access to an interactive calculator.

.webp)