Trusted by drivers at

Your team has better things to do than count miles

MileIQ lets them focus on their work — and gives you an accurate record of their drives.

Your team has better things to do than count miles

MileIQ lets them focus on their work — and gives you an accurate record of their drives.

Clear, accurate business mileage reimbursements

Need employee mileage reimbursement software that won’t take days to figure out? Meet MileIQ for Teams — and never search your inbox for drive reports again.

All things mileage–made easier

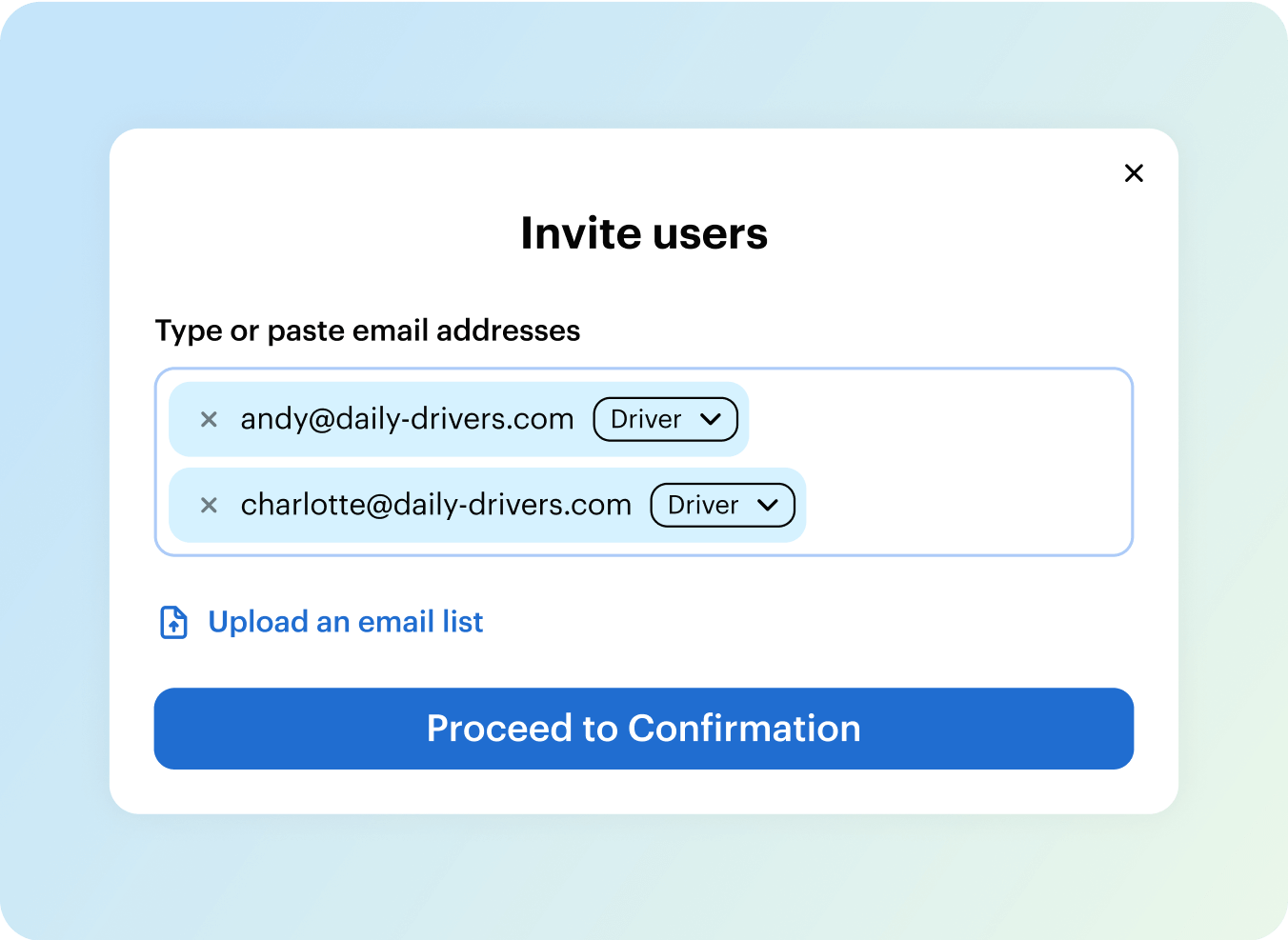

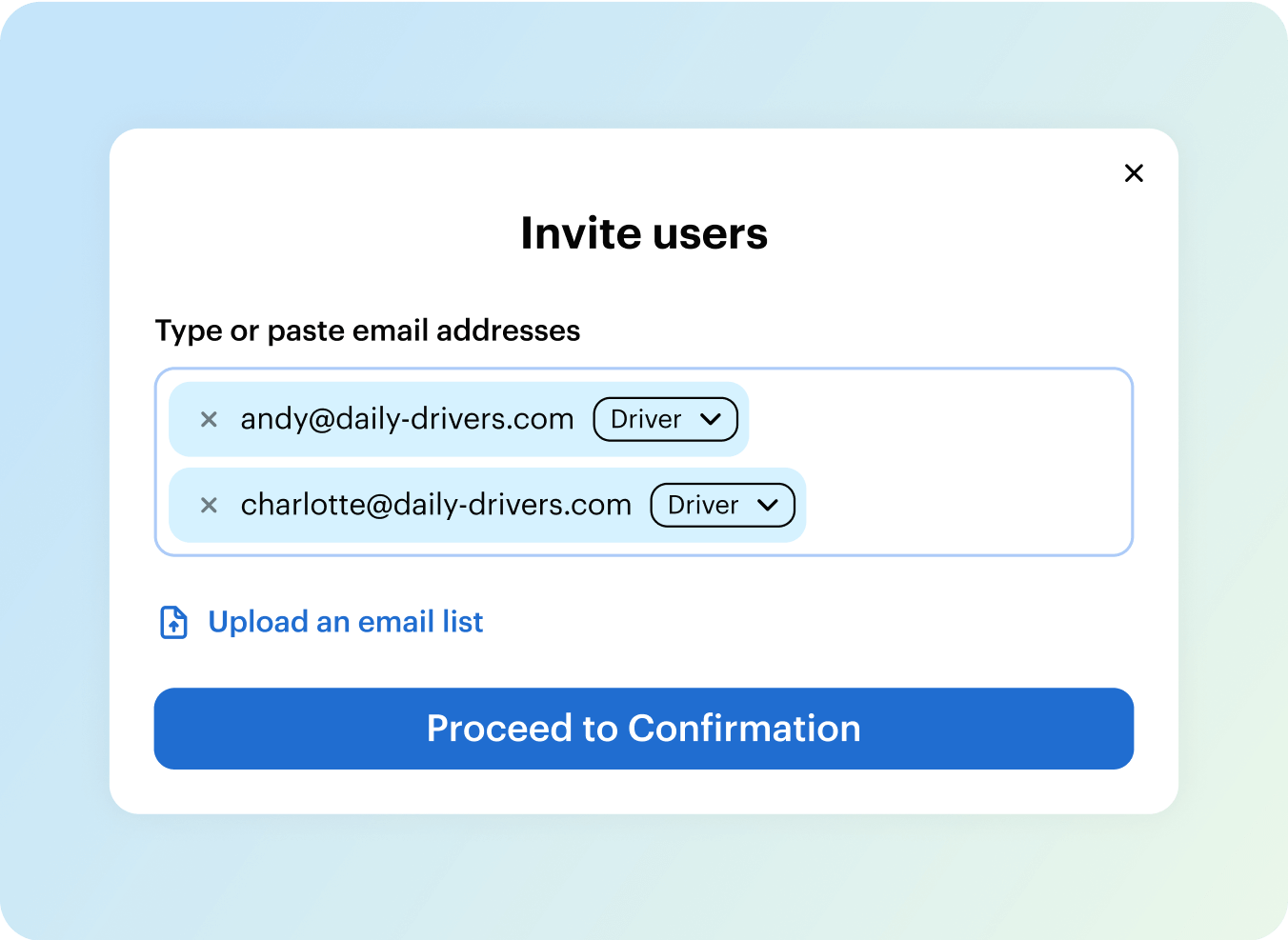

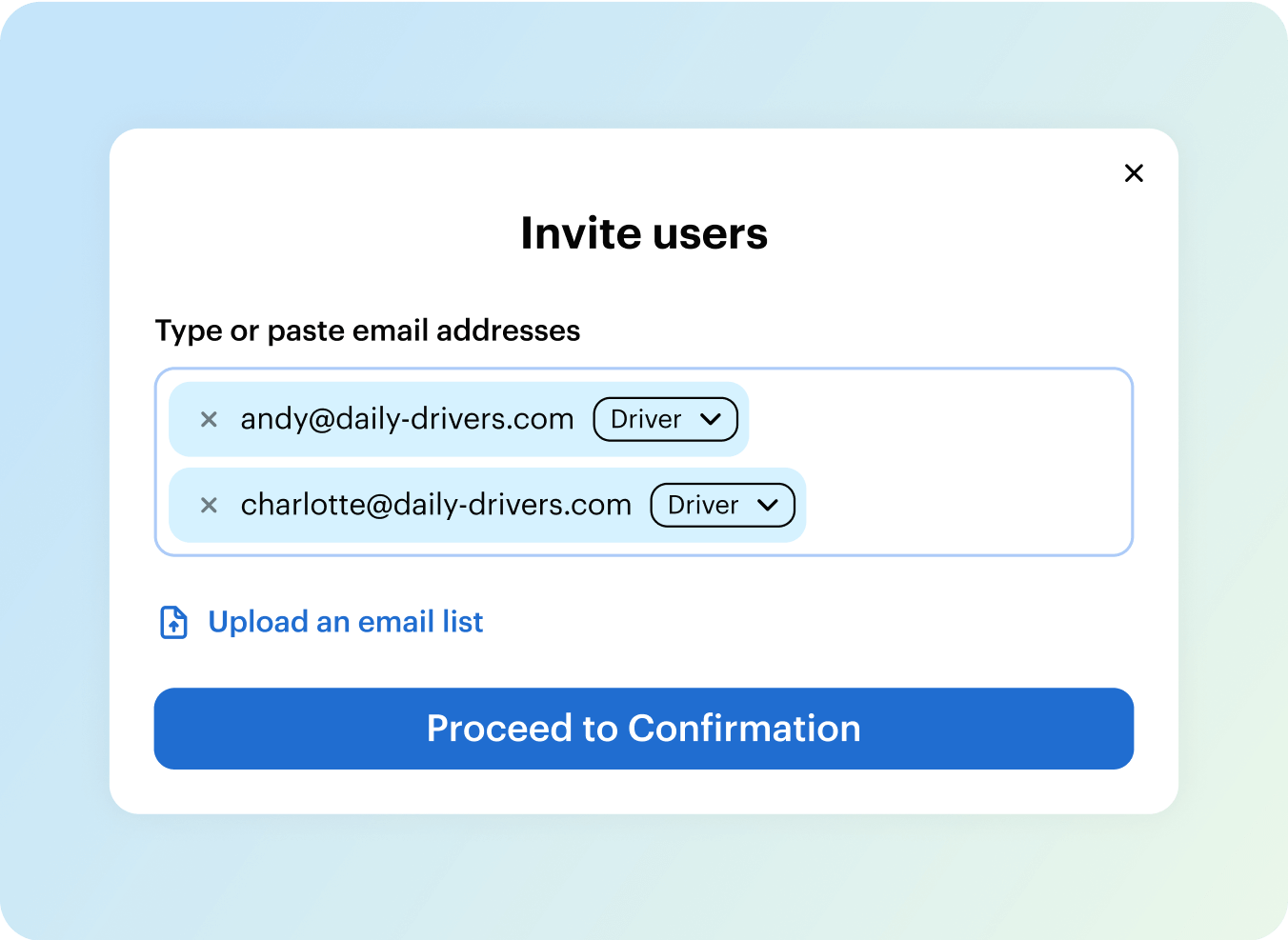

Onboard your team in minutes

Create an account and add your drivers with an automated email invite.

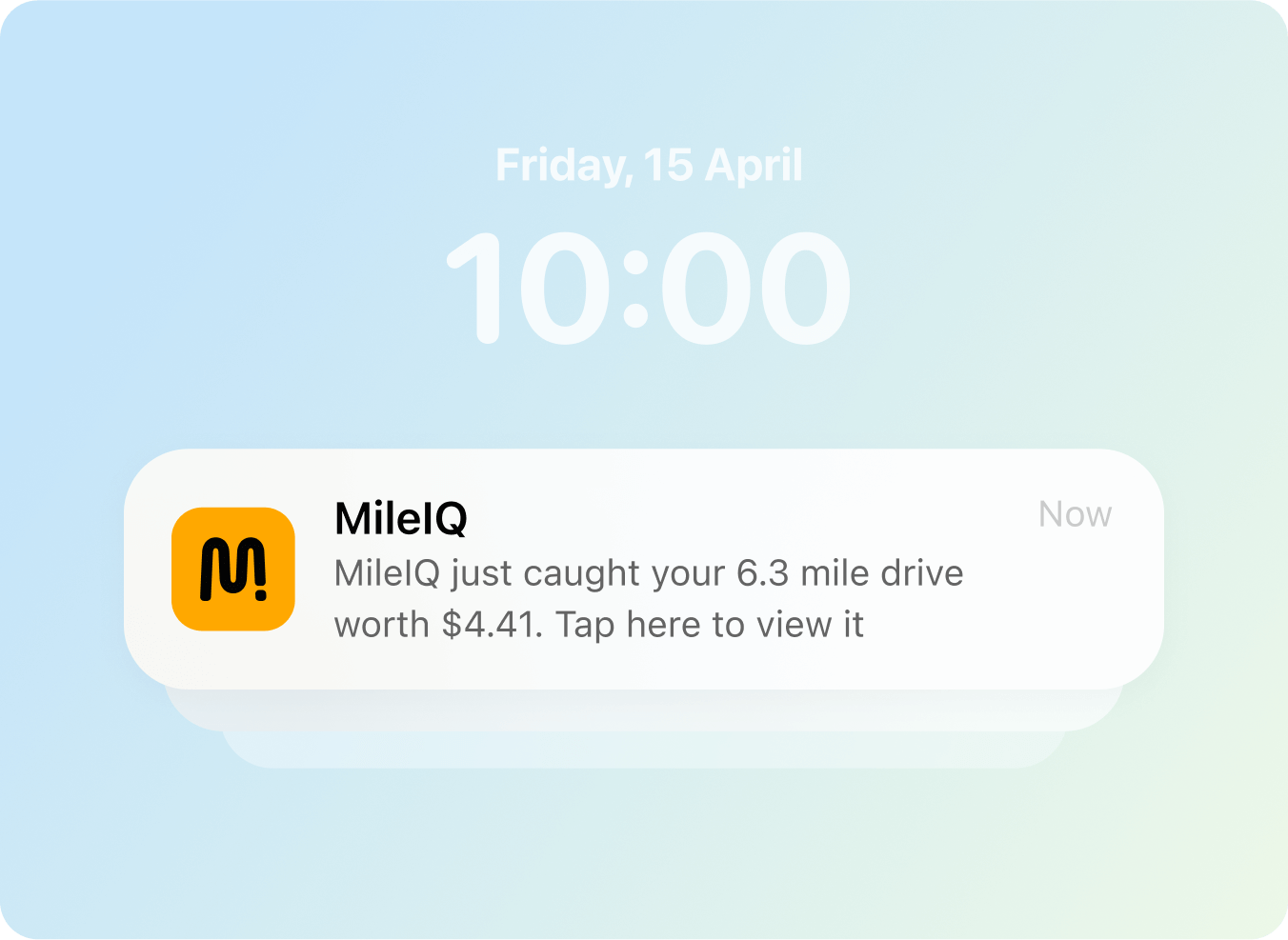

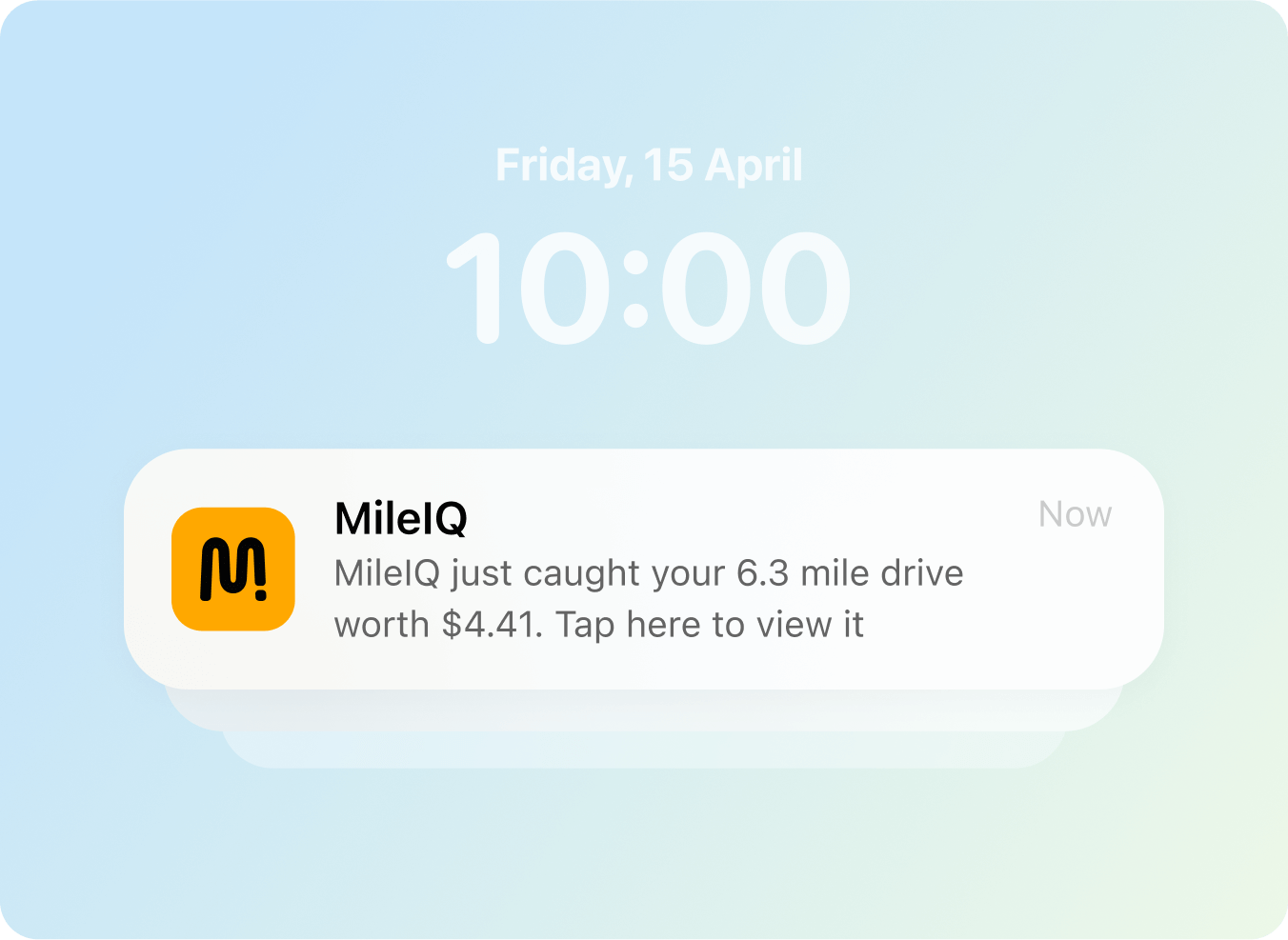

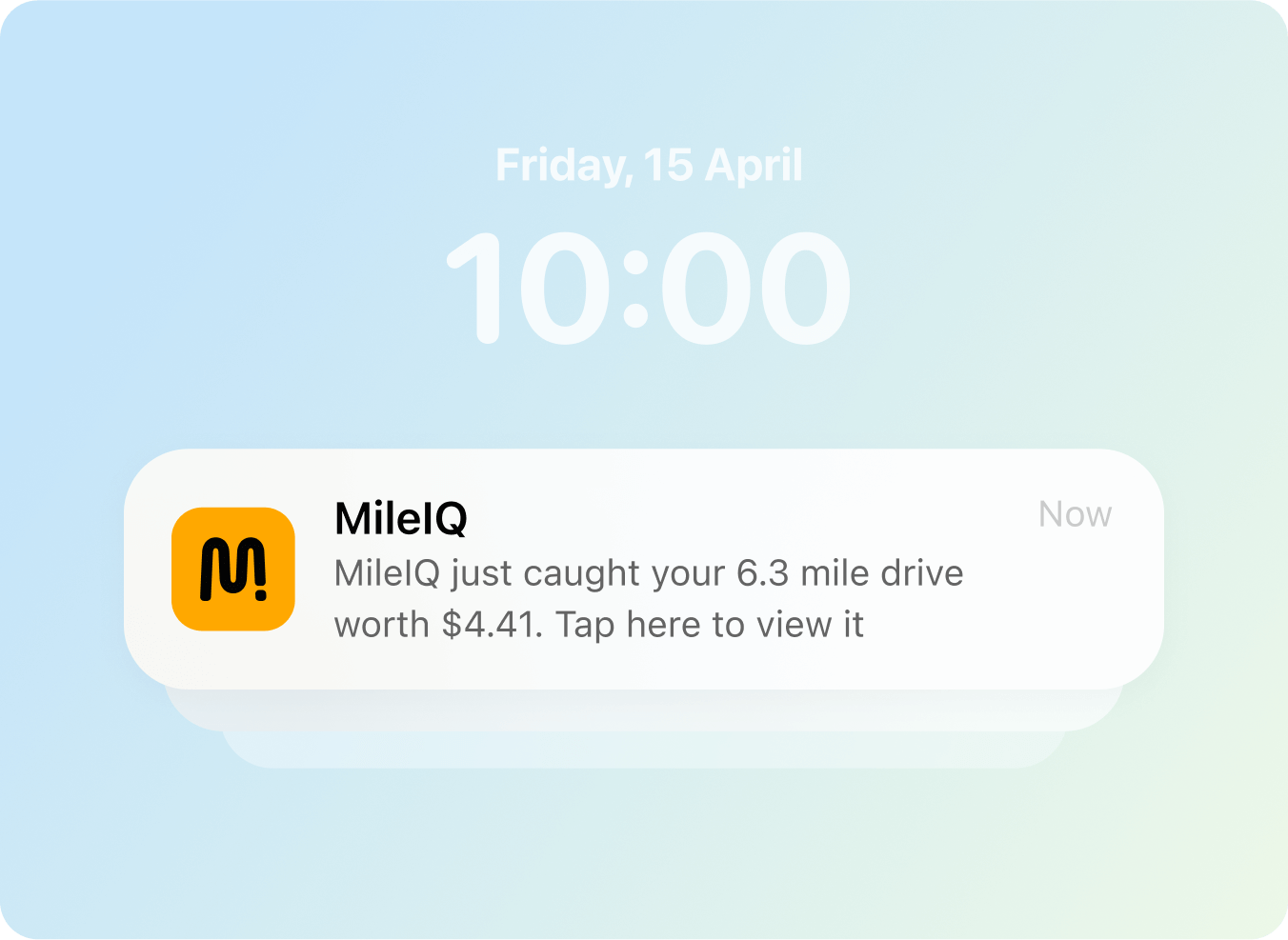

Drives are tracked automatically and accurately

All drivers need is their phone — the MileIQ app works in the background, recording every mile driven.

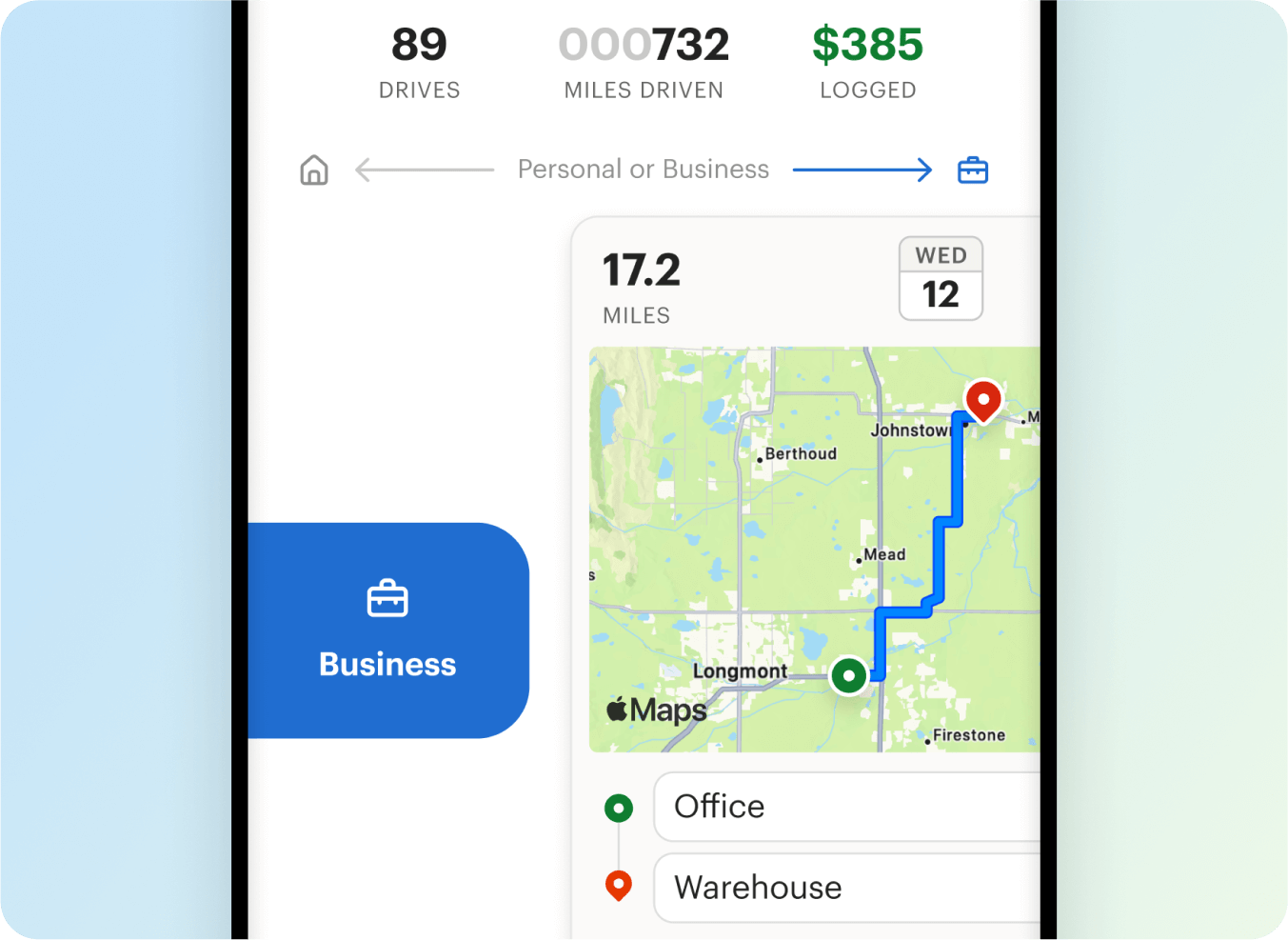

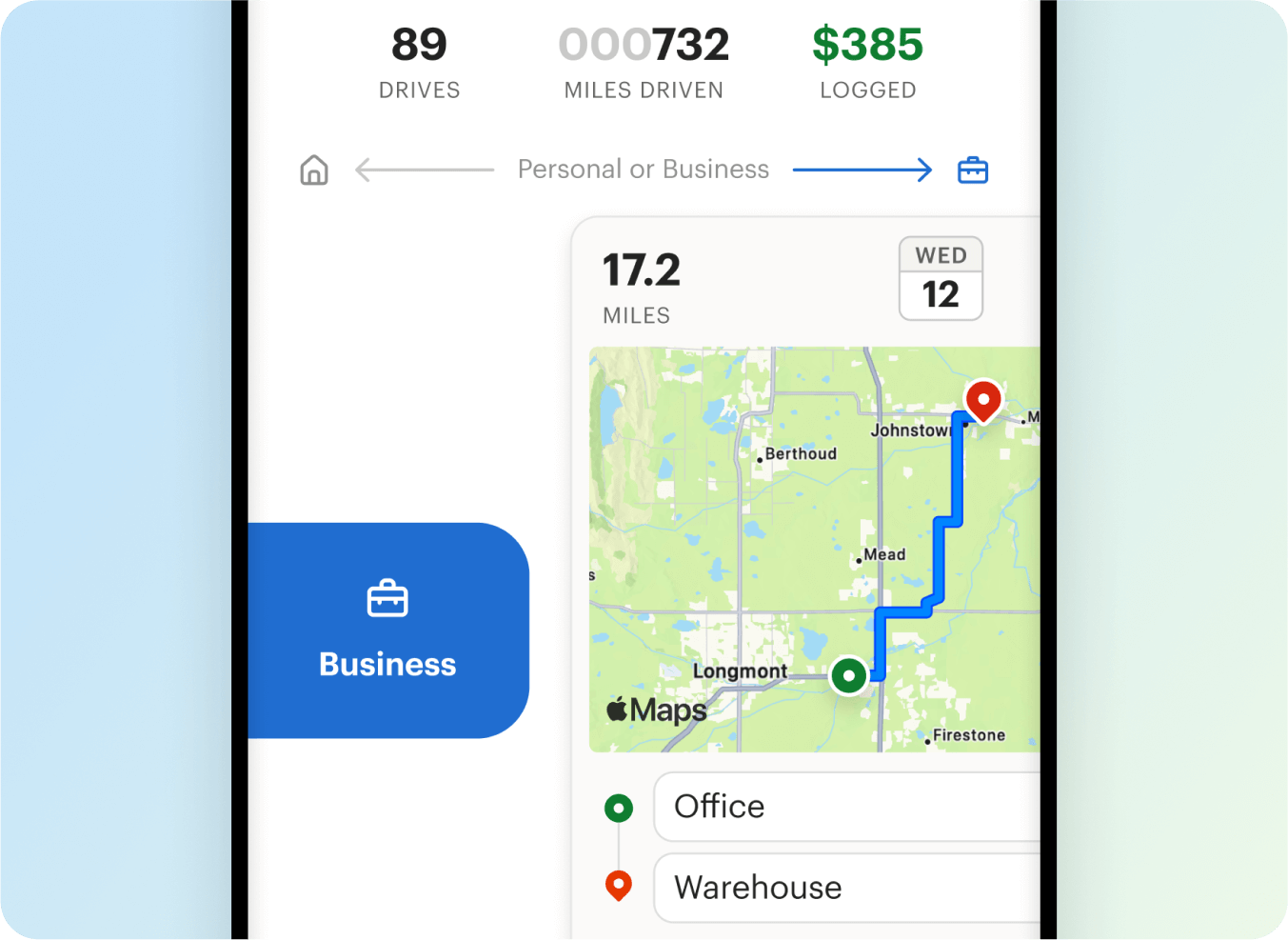

Simple and effortless drive classification

Drivers can auto-classify drives, or swipe left for personal and right for business.

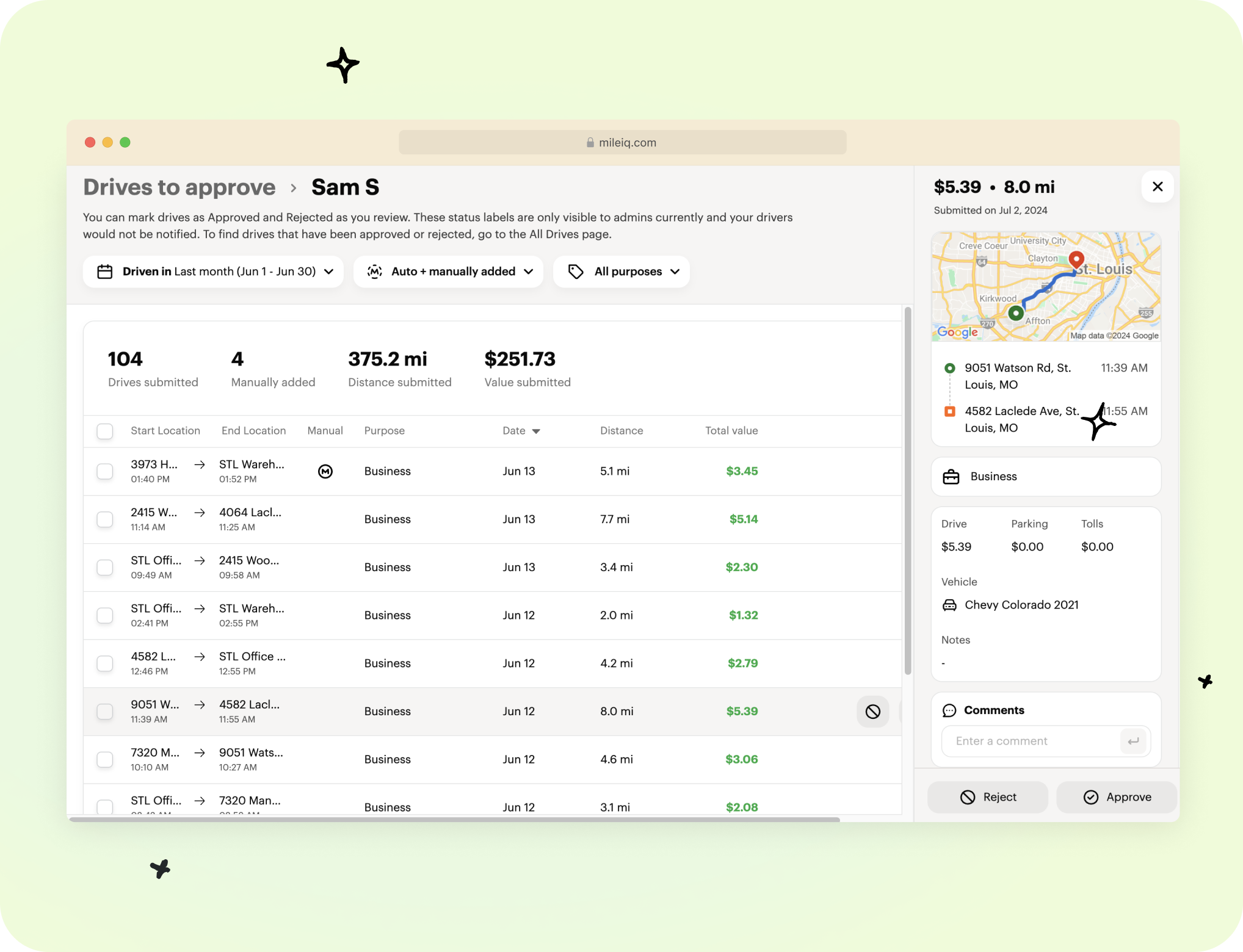

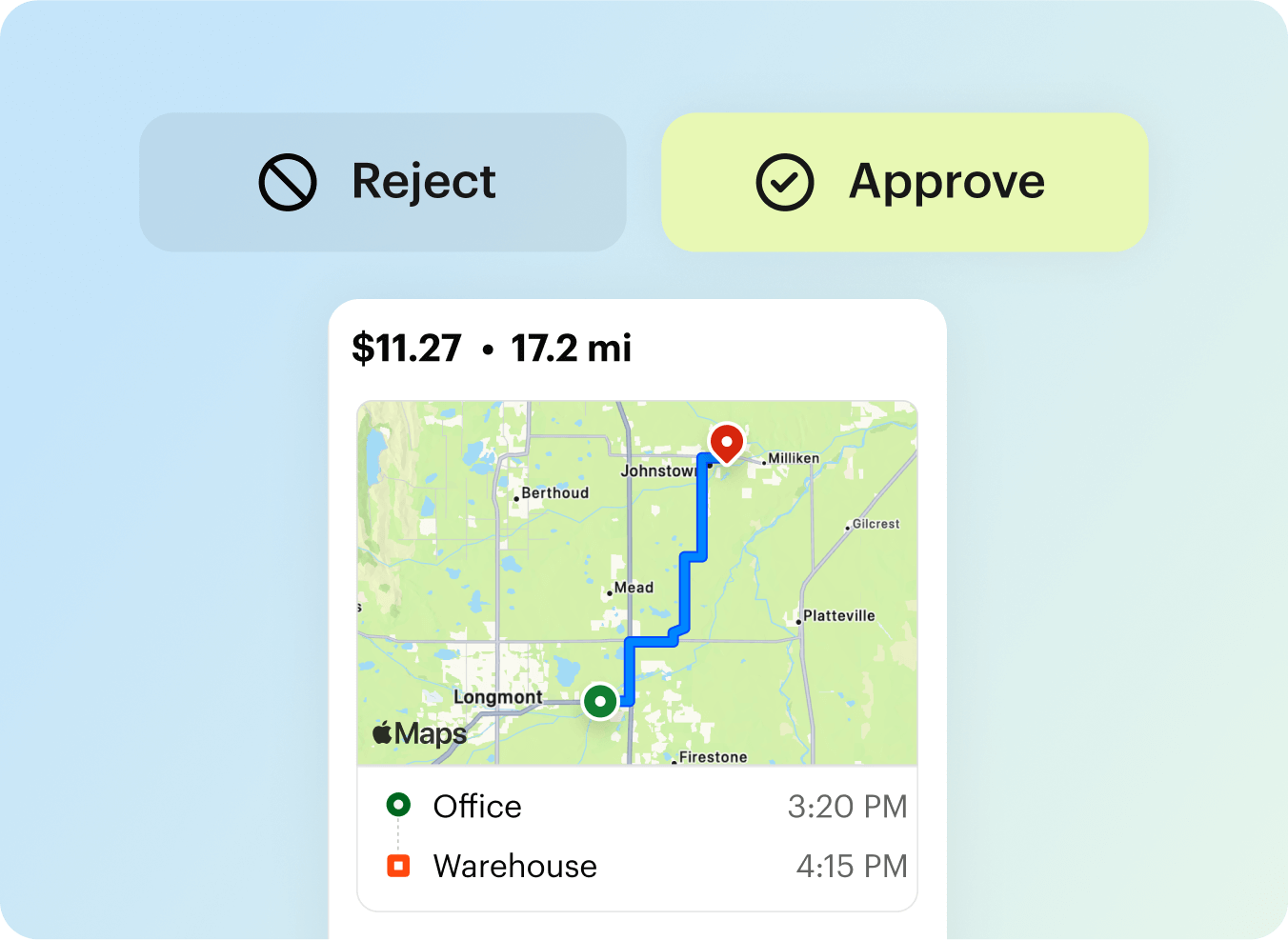

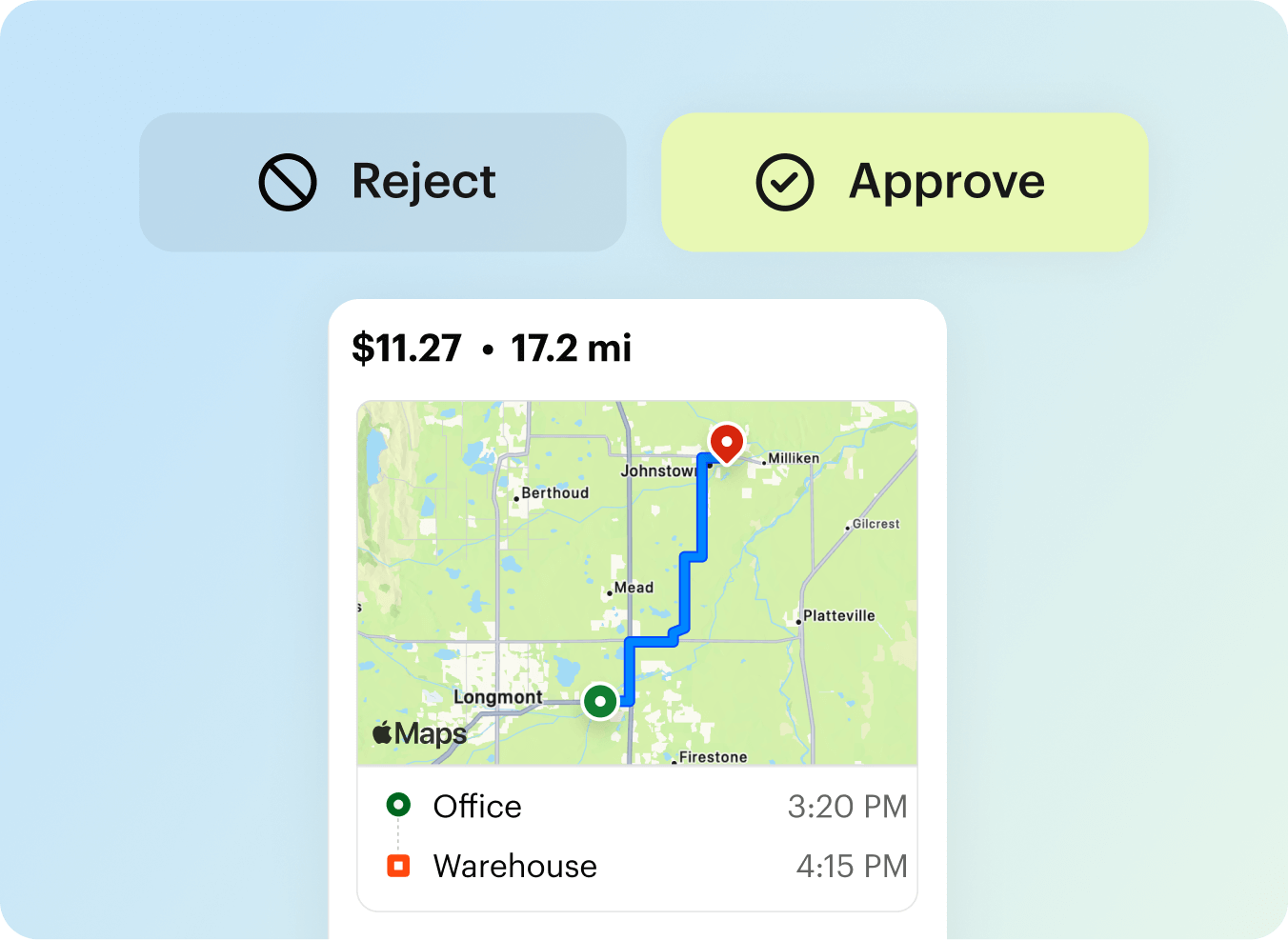

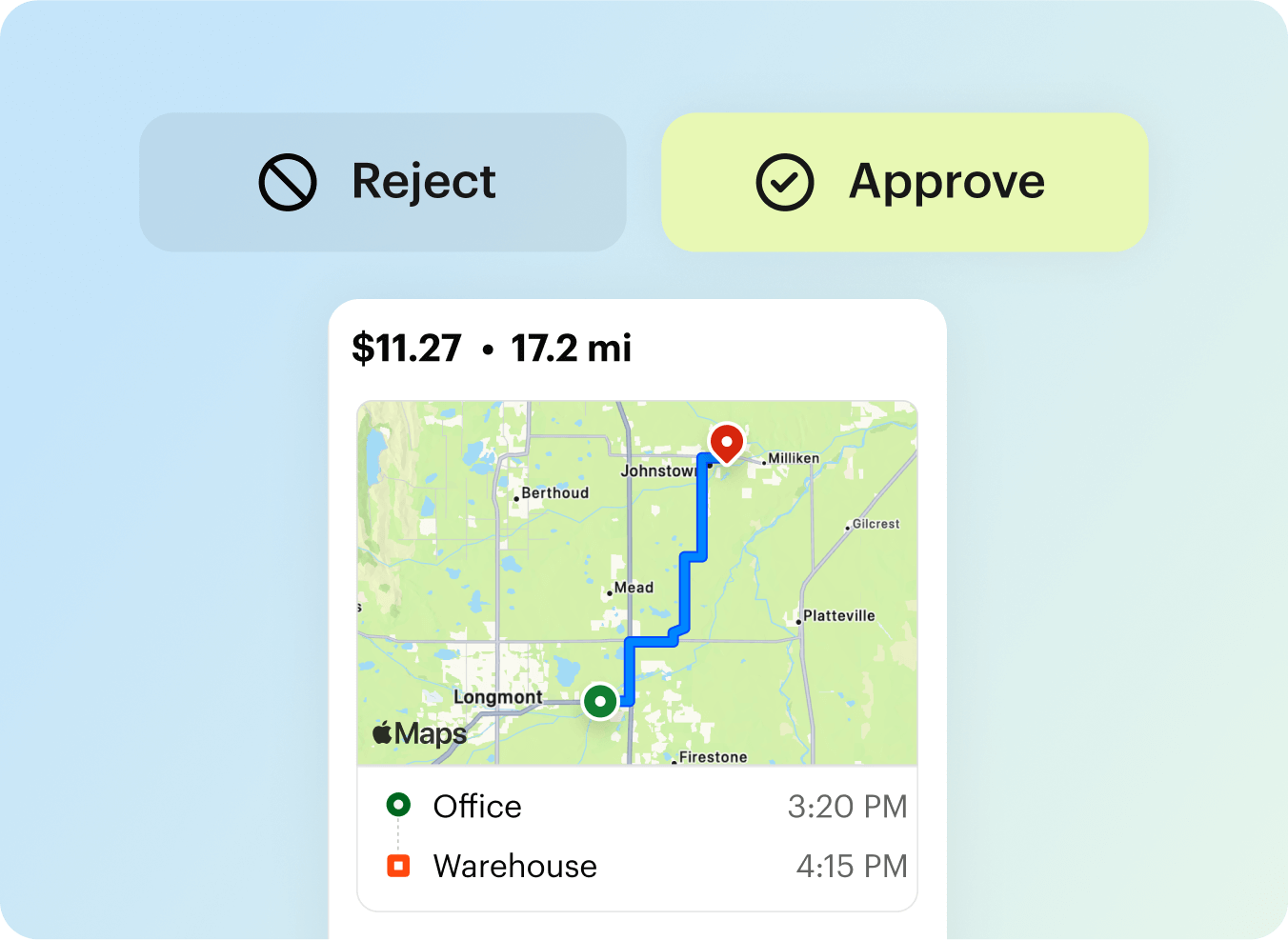

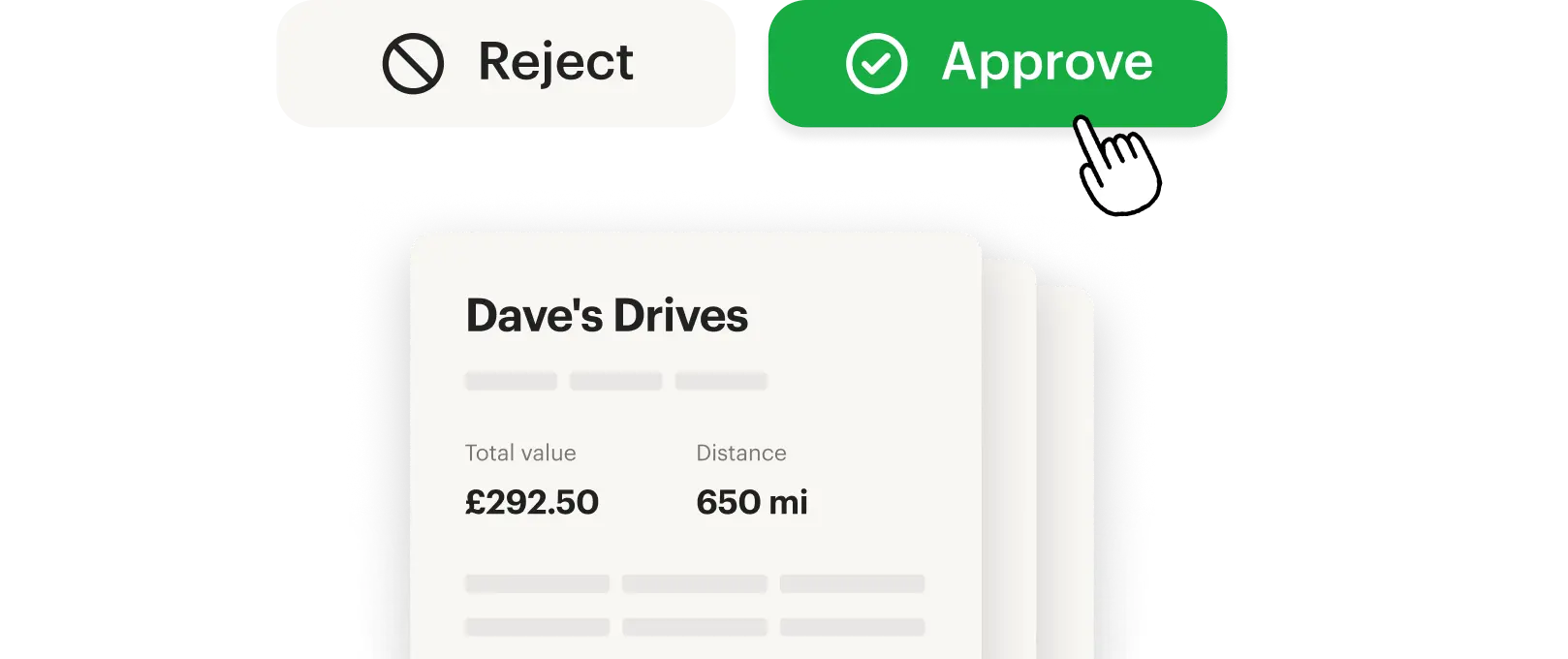

Validate drives faster

Save time with all drive data in one place. See all the information you need for approval.

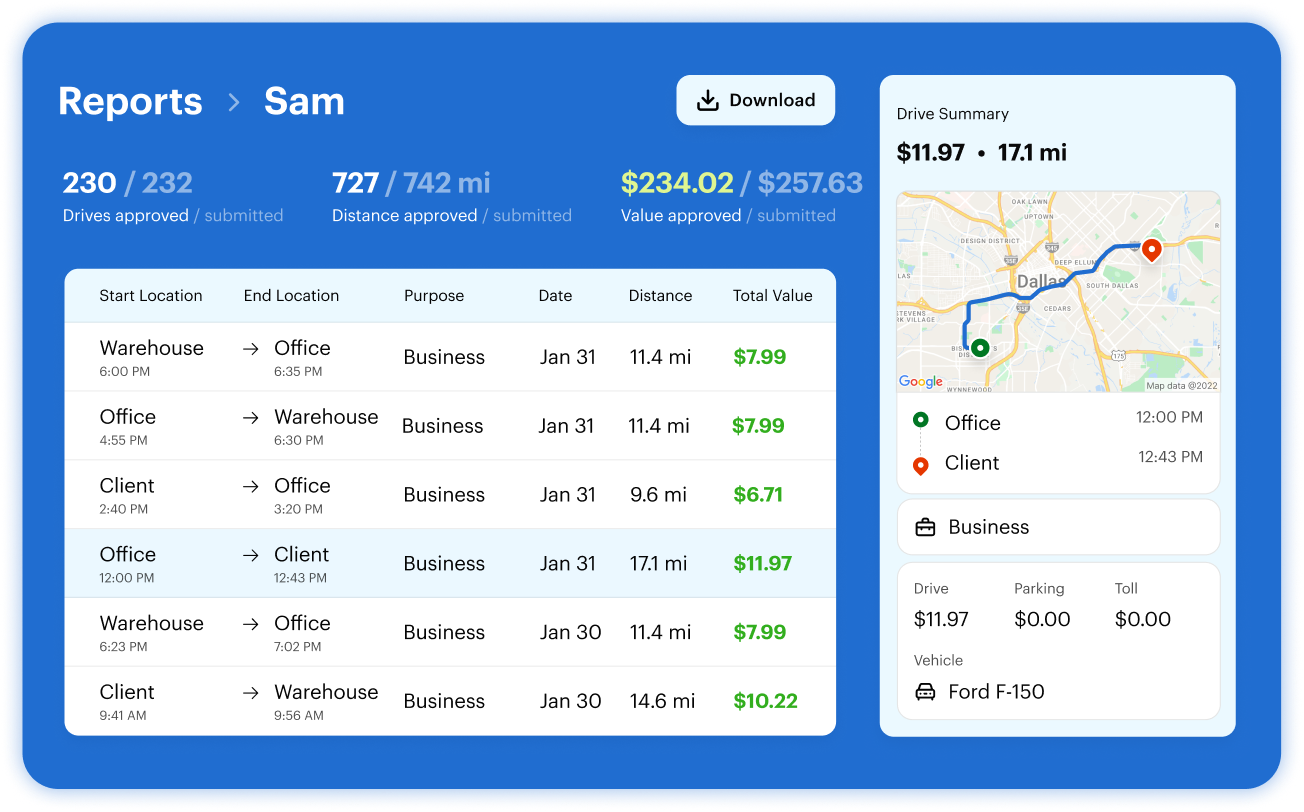

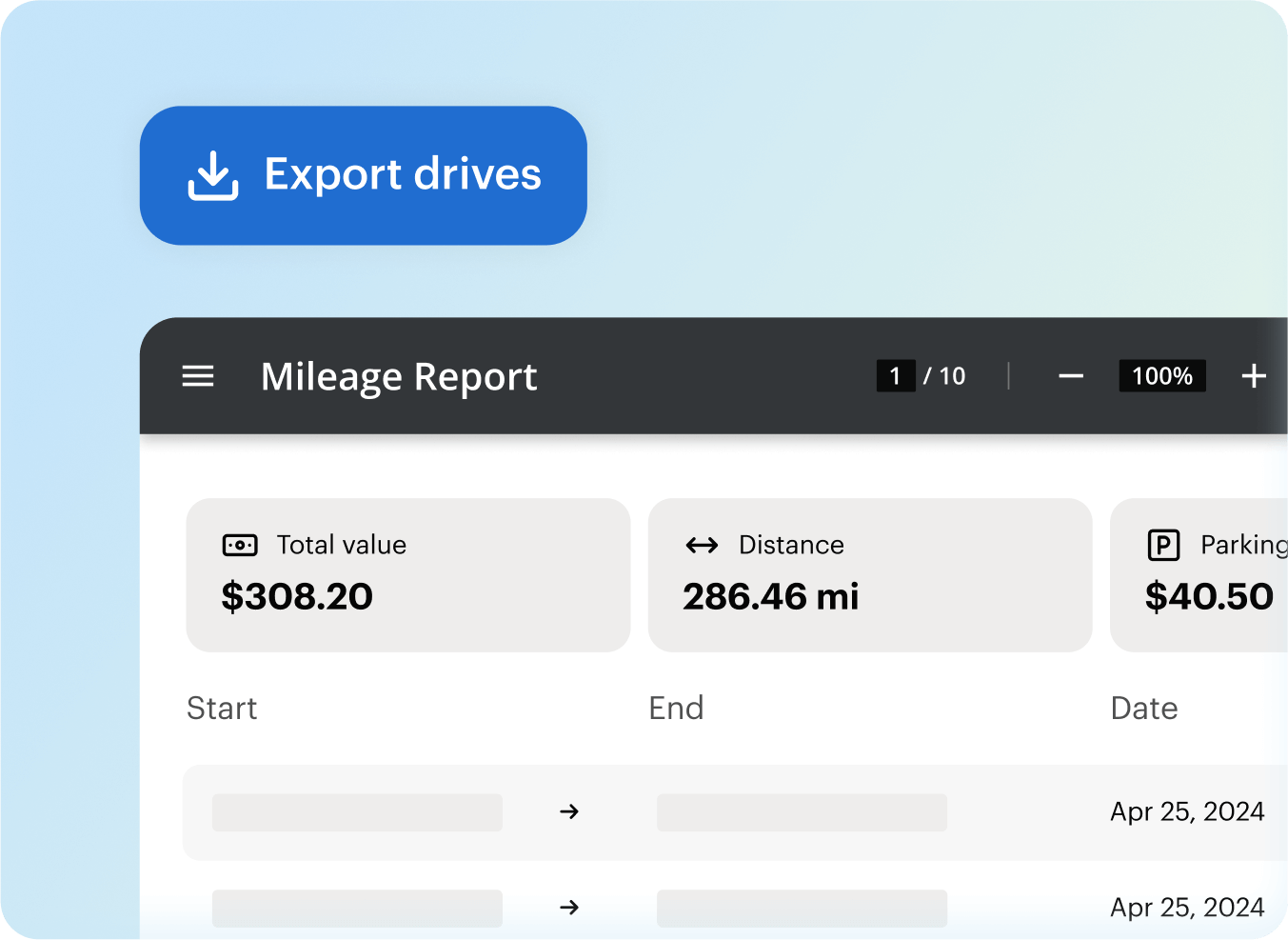

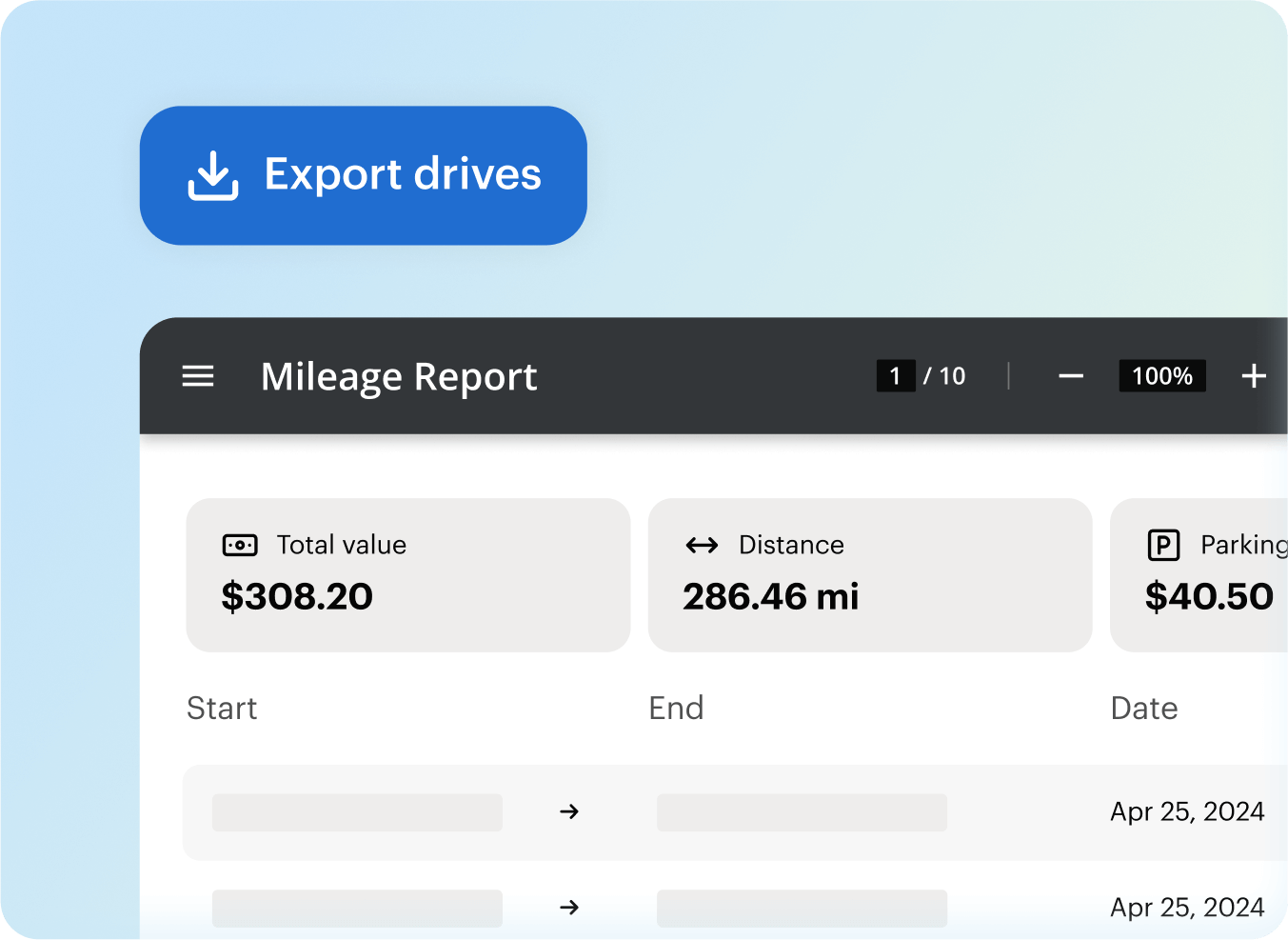

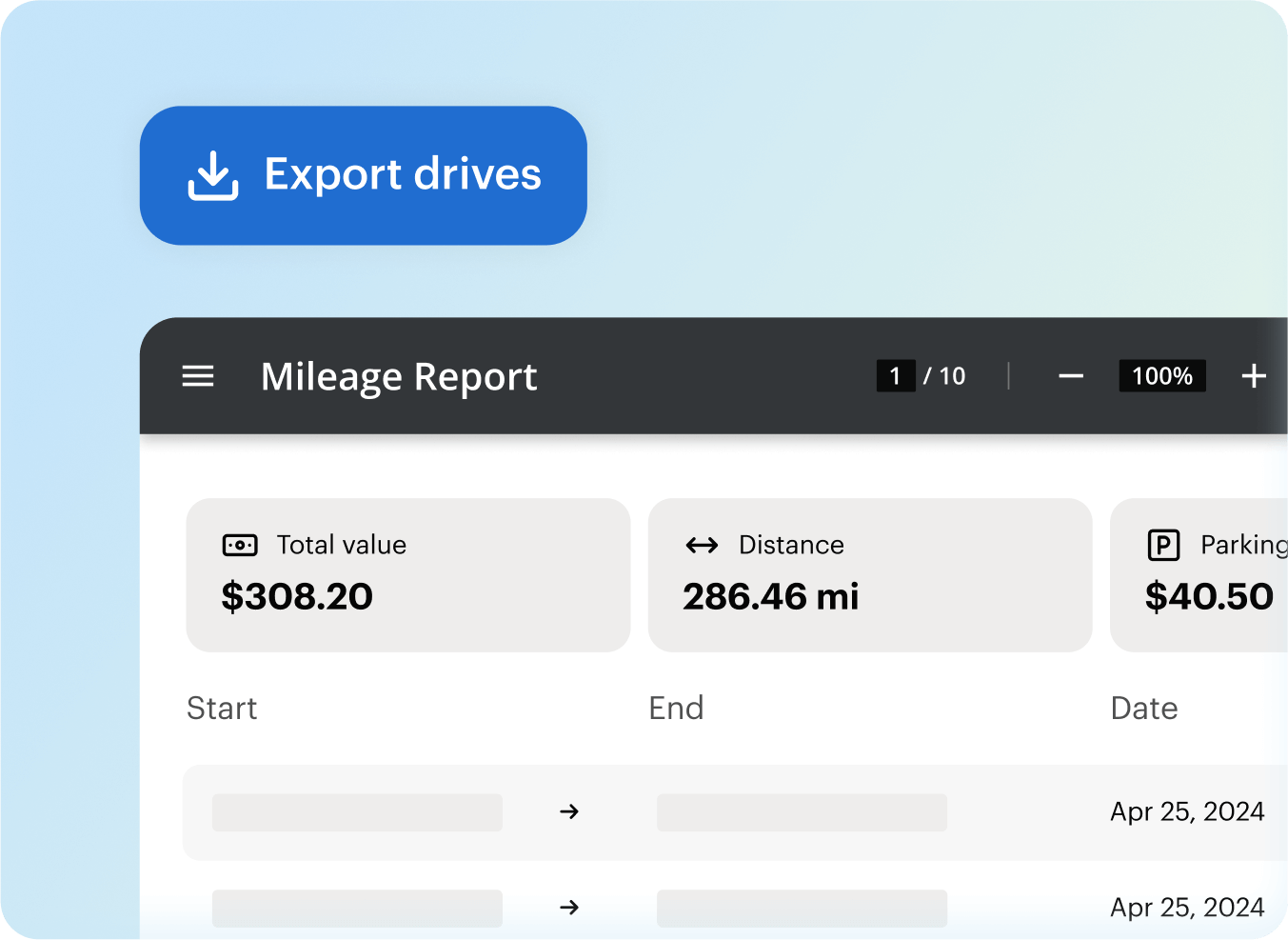

Compliant mileage reports, ready for payroll

Download tax-compliant mileage reports and pass on for fast and accurate reimbursements.

All things mileage–made easier

Onboard your team in minutes

Create an account and add your drivers with an automated email invite.

Drives are tracked automatically and accurately

All drivers need is their phone — the MileIQ app works in the background, recording every mile driven.

Simple and effortless drive classification

Drivers can auto-classify drives, or swipe left for personal and right for business.

Validate drives faster

Save time with all drive data in one place. See all the information you need for approval.

Compliant mileage reports, ready for payroll

Download tax-compliant mileage reports and pass on for fast and accurate reimbursements.

Employee mileage reimbursements made easy

Onboard in minutes

Sign up and invite your team. All they need is your invite and the MileIQ app. There’s no tech jargon to learn and no complicated training.

Save time with automatic mileage tracking

There’s no start or stop button, MileIQ catches every drive as soon as it begins. Drives are classified as business or personal with a swipe — or automatically, based on work schedule and frequent drives.

See all reports in one dashboard

Review and verify every report in one place. Teams reports are QuickBooks-compatible and integrate seamlessly with Concur. Simply download and pass on for reimbursement.

Automate tedious reimbursement tasks

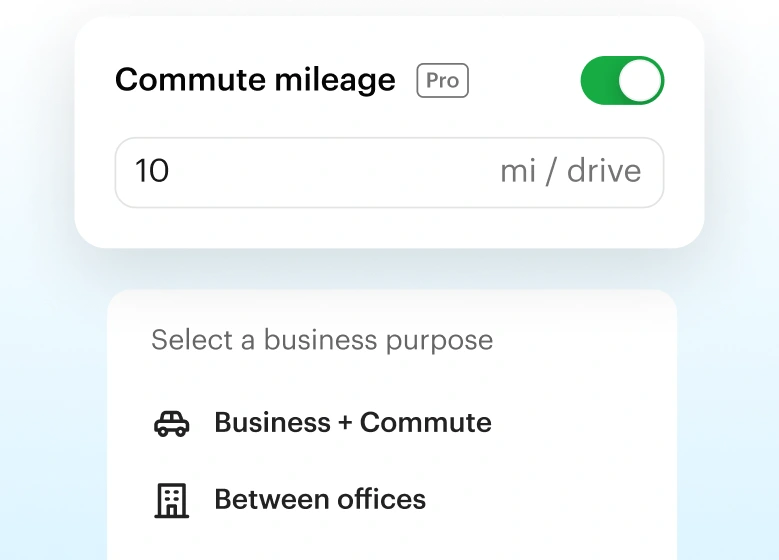

Set a commute mileage policy and MileIQ will automatically deduct those miles for you. Send automated report reminders (let us do the nagging for you!), or ask drivers to send automated reports!

MileIQ makes life easier

Our features make mileage tracking and reimbursement simple.

MileIQ makes life easier

Our features make mileage tracking and reimbursement simple.

Your complete mileage reimbursement toolkit

Mileage reimbursement software that works with your whole team — from automatic mileage tracking to compliant reporting.

Your team downloads the app — we do the rest

Available for iOS and Android, the MileIQ app works in the background, automatically tracking your employees’ drives. Learn more

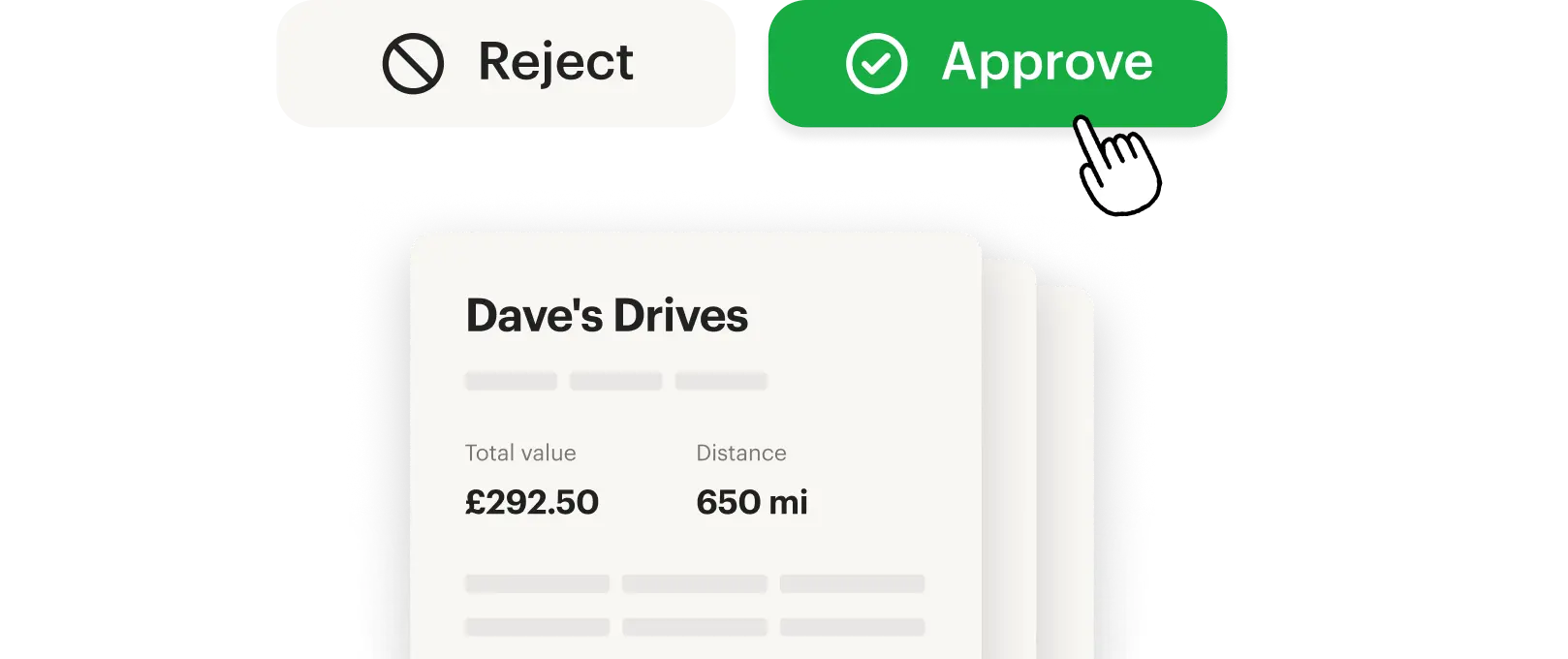

Easy approvals

Approve drives with a click — no sifting through spreadsheets at the end of the month. Learn more

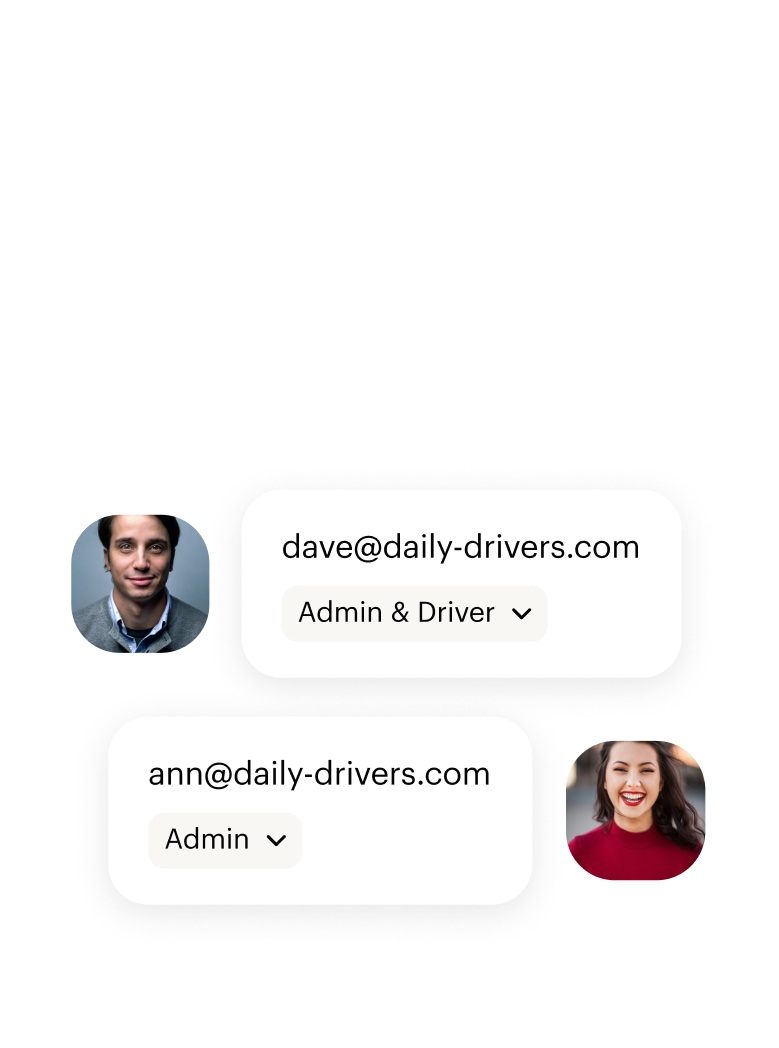

Multiple admins

Give multiple admins access to the MileIQ dashboard so they can coordinate and approve reimbursements. Learn more

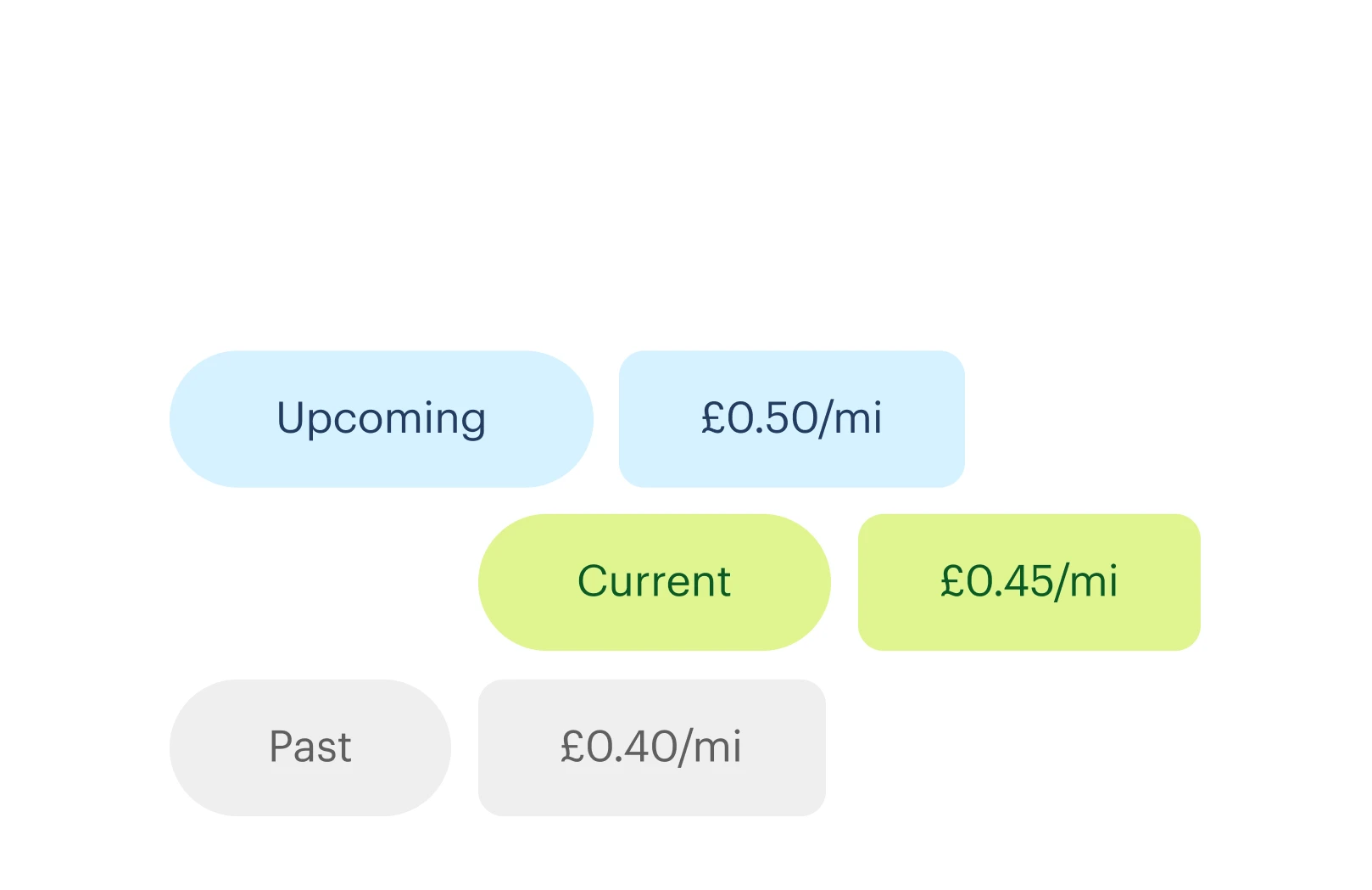

Custom mileage rates

Use MileIQ’s tax-compliant mileage rates or set your own custom rates. Learn more

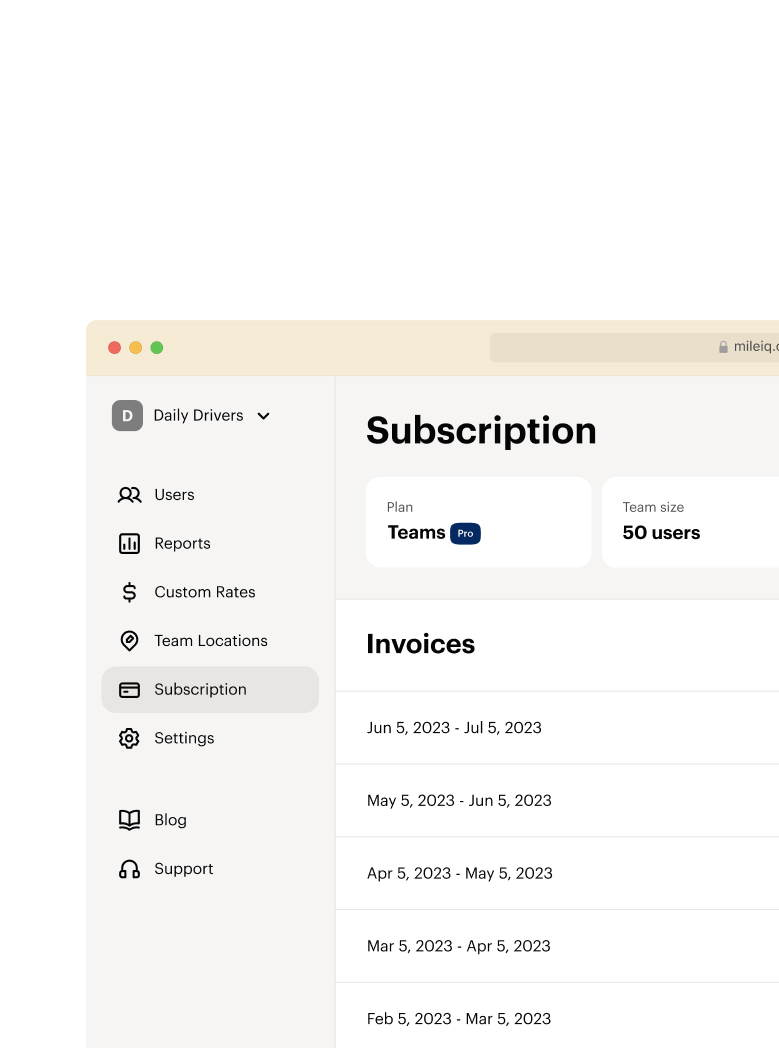

Streamlined billing

One secure place for payment. Learn more

Automatic reports & reminders

Get weekly reports of all submitted business drives. Set an automatic reminder for your team to submit a report. Learn more

Addresses on reports

See more detailed reports with precise start and end addresses for every drive. Learn more

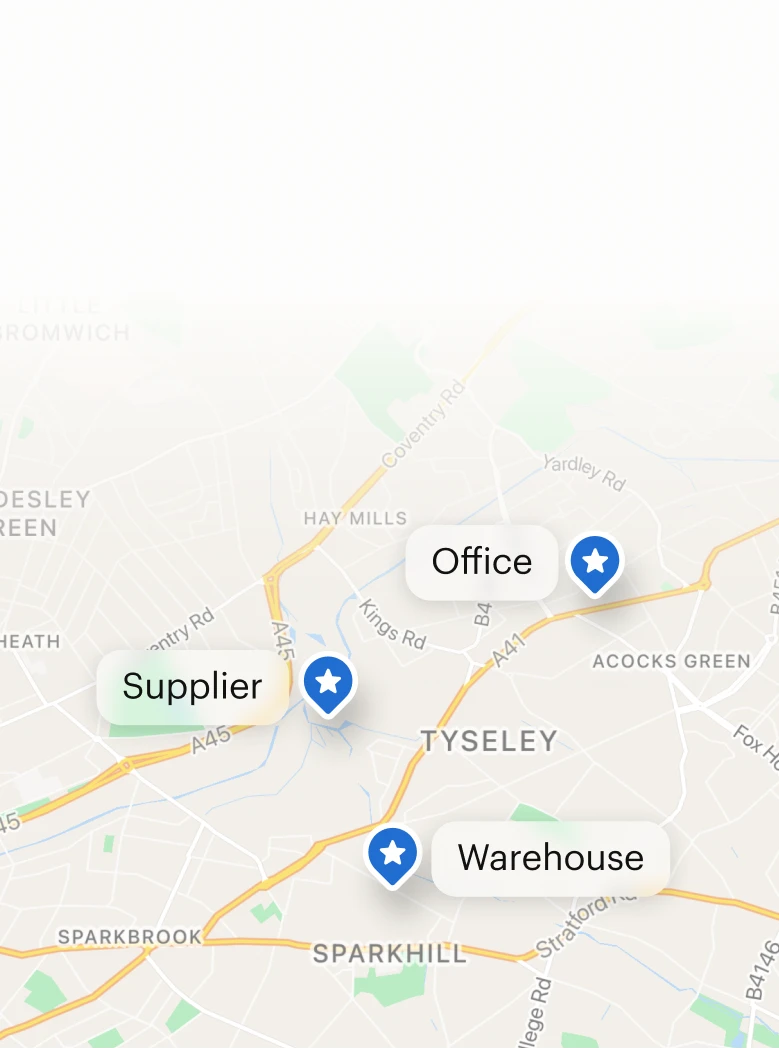

Team Locations

Team Locations are places your drivers visit often and are listed on reports for faster review. You can upload a list, add individually, or choose the ones MileIQ suggests for you. Learn more

Custom Commute Mileage

Set a personalized commute distance for each driver on your team — and MileIQ will deduct it automatically. Learn more

Companies love us

Over 10,000 businesses and millions of drivers use MileIQ as their business mileage tracking solution.

MileIQ is the #1 mileage tracking app

80,000+ 5-star ratings on the Apple App Store and Google Play