Trusted by drivers at

Home Depot

Best Buy

PepsiCo

Staples

Starbucks

Allstate

FedEx

Century 21

Long & Foster

Zillow

Walgreens

Edmunds

Vivint

Pella

Marriott

Coldwell Banker

Home Depot

Best Buy

PepsiCo

Staples

Starbucks

Allstate

FedEx

Century 21

Long & Foster

Zillow

Walgreens

Edmunds

Vivint

Pella

Marriott

Coldwell Banker

Maximize mileage deductions

A team of 5 drivers can save up to $632 per month with MileIQ — $7,592 per year!

How MileIQ Works

01

MileIQ automatically classifies drives based on:

- Work Hours

- Named Locations

- Frequent Drives

02

Drivers submit reports with a tap — only business drives are included.

03

Review and approve drives with a click or edit easily — all in one dashboard.

04

MileIQ saves teams 70 payroll hrs per driver each year.

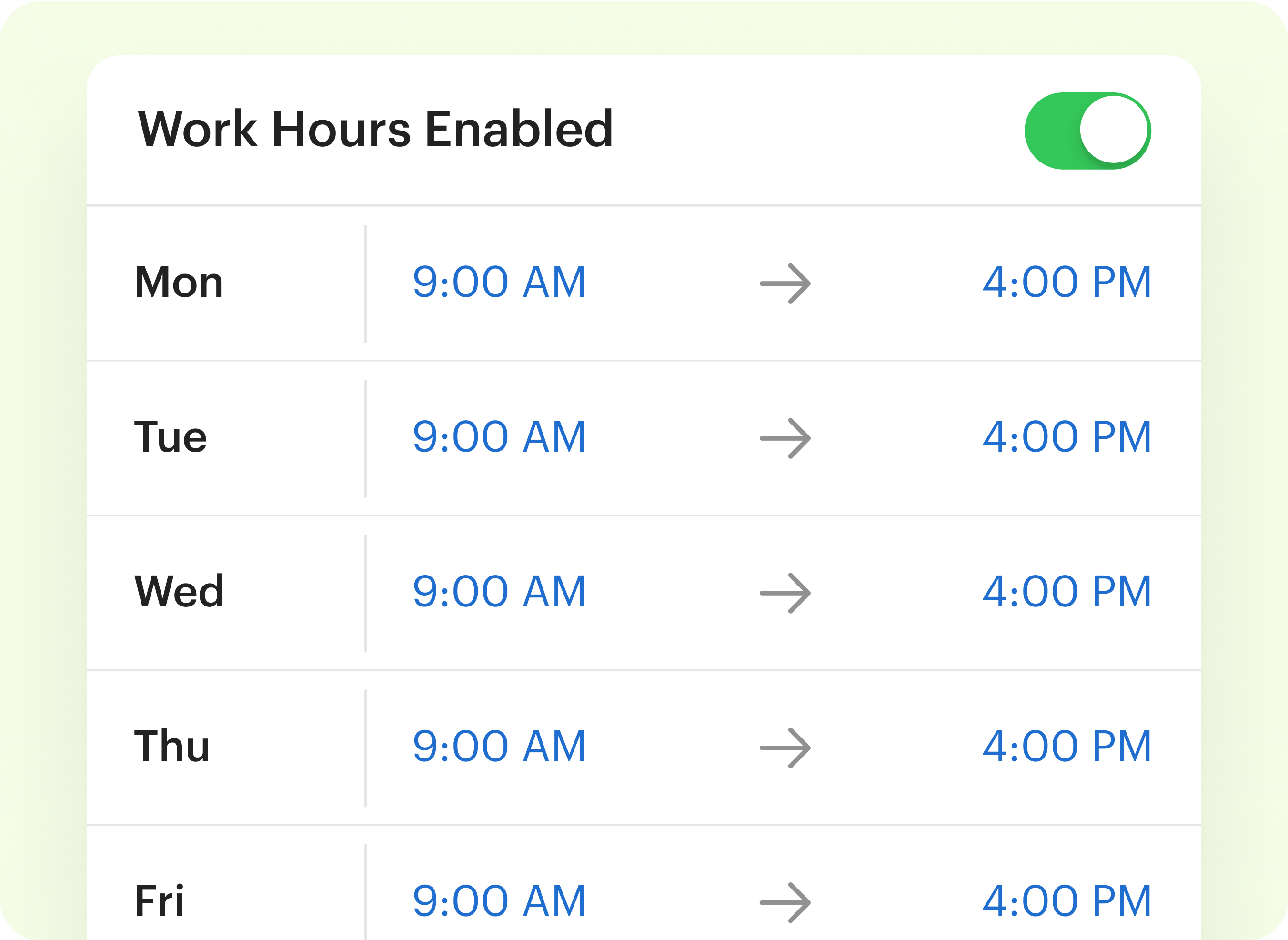

01

MileIQ can automatically classify drives for you based on your Work Hours.

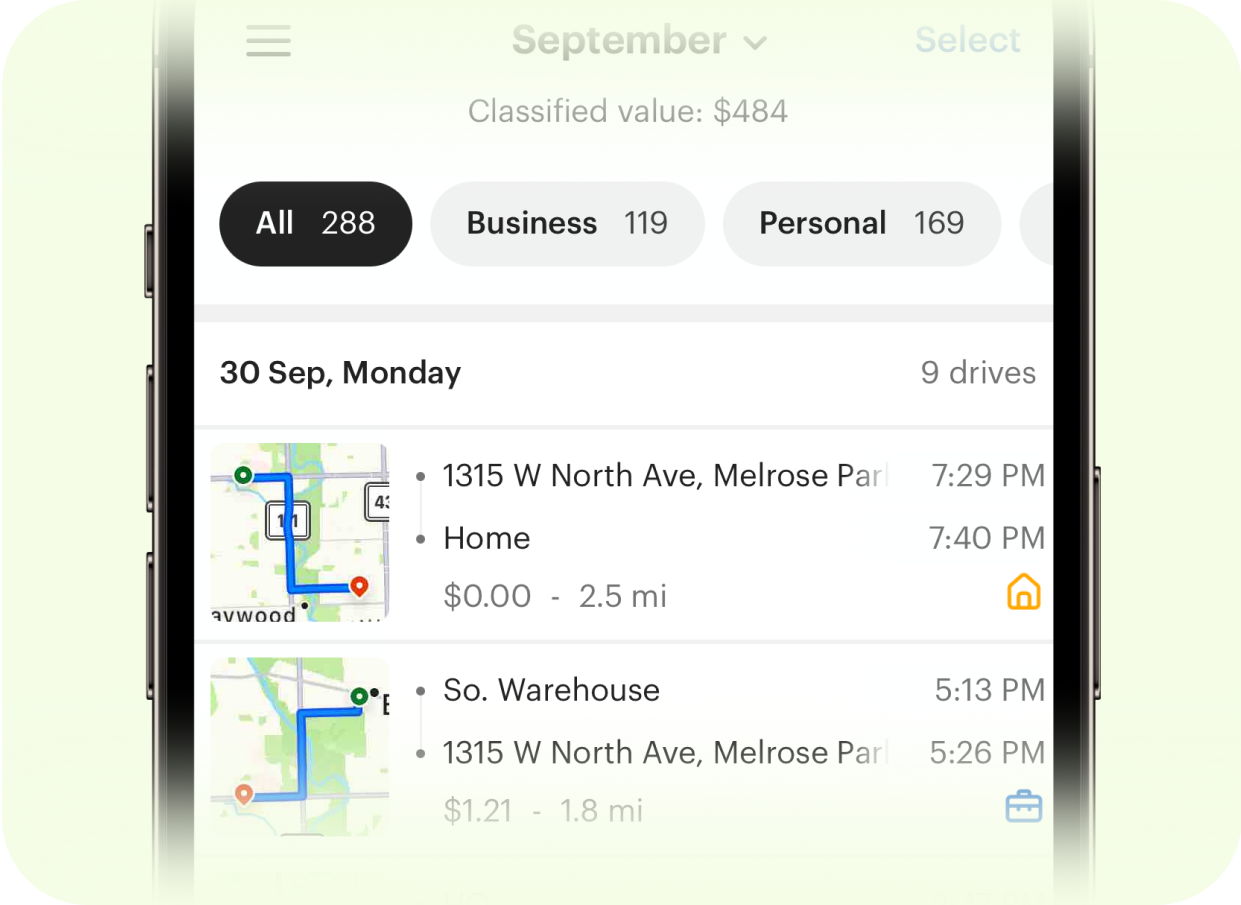

02

Or… you can classify a drive as business or personal with a swipe.

03

Tap to submit a report anytime.

04

MileIQ saves drivers 70 hrs per year on mileage tracking.

The #1 mileage tracking app

80,000+ 5-star ratings on the Apple App Store and Google Play

Keeping your data safe

We created our app with privacy top-of-mind. MileIQ will never sell your data or share it with an employer. You can also choose which drives you want to include in a report when submitting your mileage.

Learn More About Driver Privacy

Learn More About Driver Privacy

What data does MileIQ track?

MileIQ needs location and motion & fitness data to track drives and savings automatically.

You can always turn off permissions when you’re done tracking drives, like at the end of a shift.

Who can see my data?

No one — including employers and team members — can see your drive data unless you send them a report. Drives classified as personal are never included.

We never sell user data for profit. Any data we use for analytics is anonymized.

What happens to my data?

MileIQ keeps your data for seven years, so you have access to it in case of an IRS audit. After that, data is deleted.